illinois property tax due dates 2021 second installment

Tuesday March 2 2021 Late Payment Interest Waived through Monday May 3 2021. The due date for Tax Year 2020 First Installment was Tuesday March 2 2021.

Your 2020 Cook County Tax Bill Questions Answered Medium

2022 Mobile Home Tax Due August 26 2022.

. Due Dates Tax Year 2021 First Installment Due Date. The last day to pay the Tax Year 2020 First Installment before late-payment interest charges was Monday May 3 2021. Tuesday March 1 2022 Tax Year 2020 Second Installment Due Date.

Tribal governments will receive two payments with the first payment available in May and the second payment based on employment data to be delivered in June 2021. Important Dates subject to change without notification June 1 2022. The due date for Tax Year 2019 Second Installment was Monday August 3 2020.

If the distribution was for a 2021 excess deferral to a designated Roth account your Form 1099-R. Surplus Real Estate Sealed Bid Auction Deadline September 1 2022. Find tax information and tools for businesses including Employer ID Number EIN Employment Tax Estimated Tax and the Foreign Account Tax Compliance Act FATCA.

105 ILCS 51-4 from Ch. Add the excess deferral amount to your wages on your 2021 tax return. Friday October 1 2021 Tax Year 2020 First Installment Due Date.

Cook County hasnt faced this scenario since 2010 when tax bills were due to be paid by Nov. Property Tax Rule 462200b2 sets forth the types of documentary evidence that may constitute clear and convincing evidence sufficient to rebut the deed presumption that the owner of the legal title to property is the owner of the full beneficial interest. 2021 Real Estate Tax 1st Installment Due August 1 2022.

Dates vary by jurisdiction. It is the policy of this State that all powers granted either expressly or by necessary implication by this Act other Illinois statute or the Illinois Constitution to any public school district may be exercised by those public school districts notwithstanding effects on competition. Supplies LHI is not taxable.

The due date for the Tax Year 2020 Second Installment was October 1 2021. More detailed information about funding amounts can be found in the allocation tables above. Last Day Personal Checks Accepted.

2021 Real Estate Tax 2nd Installment Due September 23 2022. Territories will receive a single payment. If the distribution was for a 2021 excess deferral your Form 1099-R should have code 8 in box 7.

Governments of US. Before then tax bill due dates routinely missed the Aug.

Why Homes Are More Affordable Now Video Real Estate School Real Estate Agent Real Estate

Buying A Second Home Tax Tips For Homeowners Turbotax Tax Tips Videos

Deducting Property Taxes H R Block

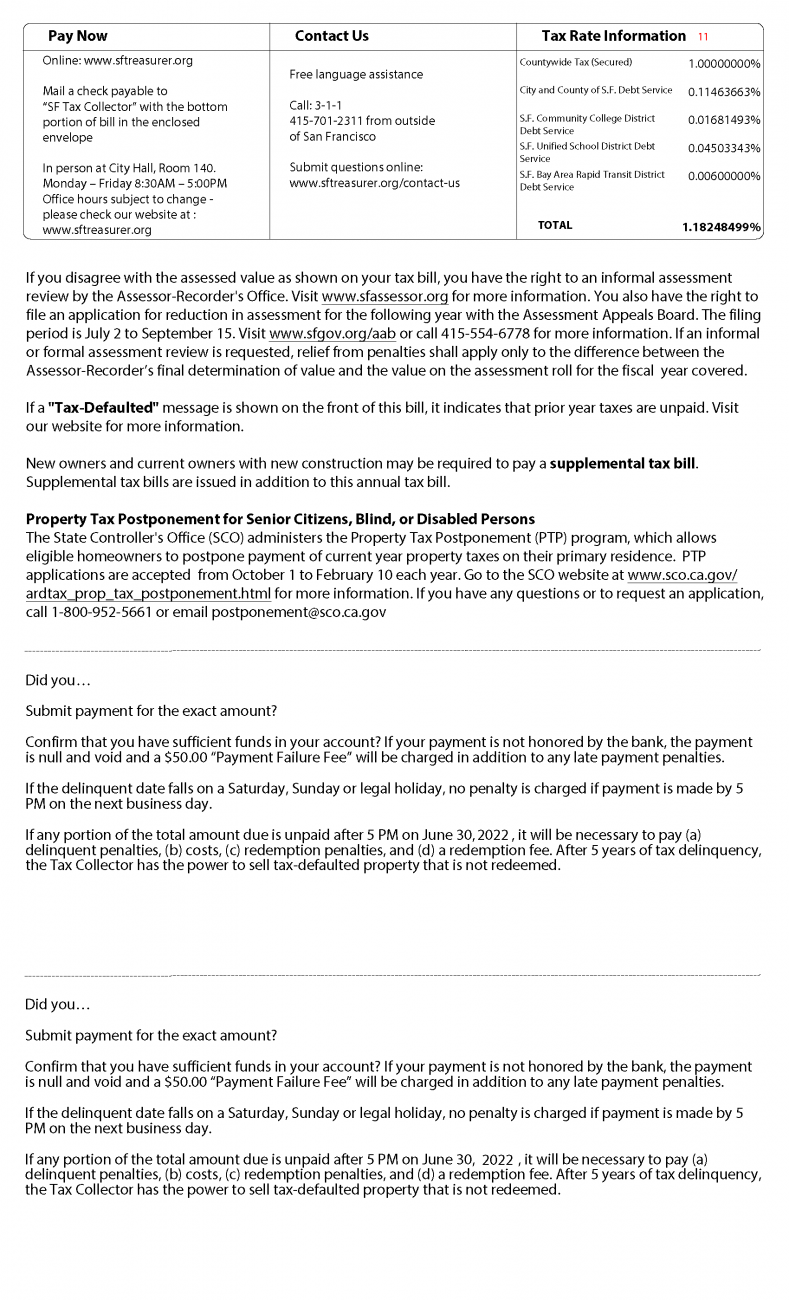

Secured Property Taxes Treasurer Tax Collector

Pin By Bobbie Persky Realtor On Finance Real Estate Tax Attorney Property Tax Debt Relief Programs

Property Taxes How Much Are They In Different States Across The Us

The Top Real Estate Terms Any Homeowner Should Know In 2021 Real Estate Terms Real Estate Contract Real Estate

Your 2020 Cook County Tax Bill Questions Answered Medium

Types Of Taxes Income Property Goods Services Federal State

Tax Treatment Of Income Under The Head Income From House Property

Secured Property Taxes Treasurer Tax Collector

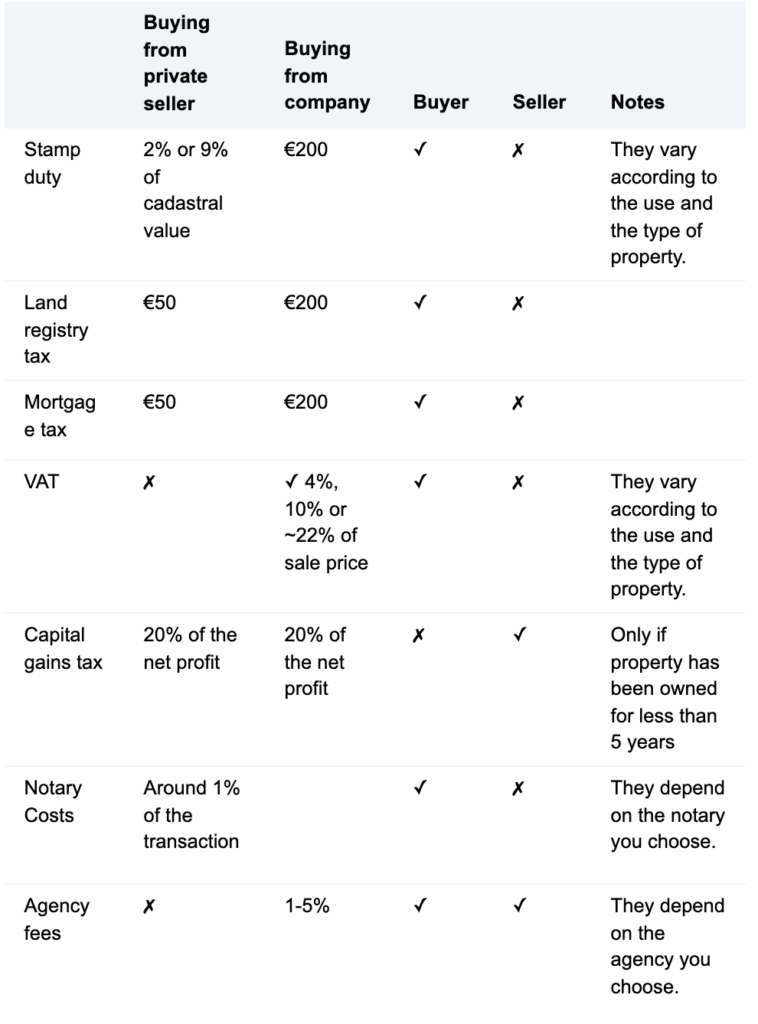

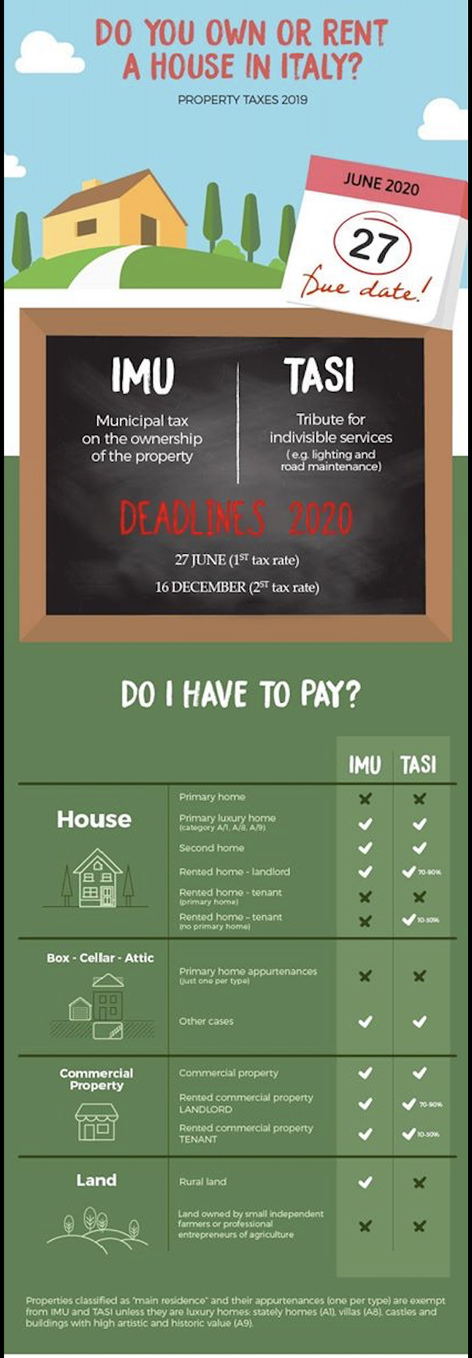

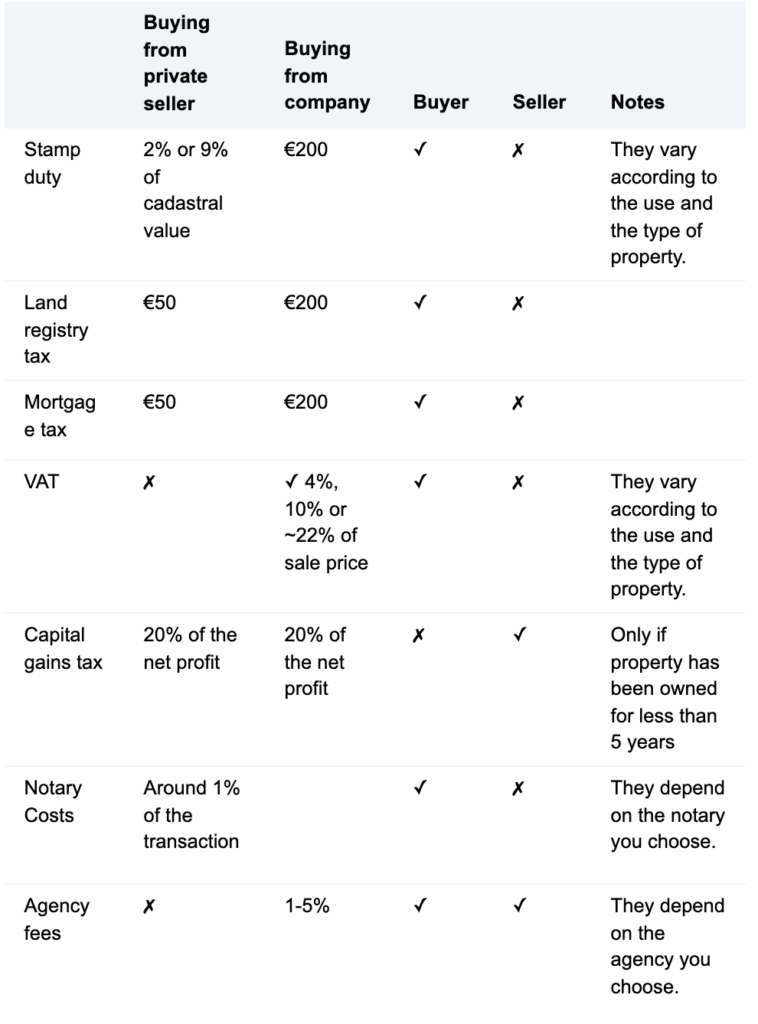

Property Tax In Italy The Ultimate Guide For 2020 Accounting Bolla

Property Tax In Italy The Ultimate Guide For 2020 Accounting Bolla

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

Secured Property Taxes Treasurer Tax Collector

What Is Capital Gains Tax And When Are You Exempt Thestreet

Property Tax Prorations Case Escrow

How Taxes On Property Owned In Another State Work For 2022

Property Tax In Italy The Ultimate Guide For 2020 Accounting Bolla